TIF collaborates with Solidaridad East & Central Africa, who provide miners with operational health and safety (OHS) and gender mainstreaming capacity support; the Chambers Federation, a gold trading family office that supports miner formalization efforts and explores offtake opportunities; and Datastake, an open-source software development company supporting TIF in the creation of a digital due diligence and ESG tracking platform to improve both miners and investor’s access to credible mine data.

To advertise the leasing model to potential clients, TIF hosts recruitment events in the gold mining communities, where participation is by word-of-mouth referrals or referrals from the Regional Mining Officers in the localities. The minimum requirements for onboarding include business registration to verify the legitimacy of their operations, land rights for their area of operation, active production status for at least six months, and a minimum of three months of production records.

TIF has secured a financing commitment of USD 450,000 in returnable funds on a debt basis, from a private investor to provide equipment through the lease-to-purchase model in 2022. To date, USD 138,000 has been deployed across ten ASGM operators in Kenya. Contracts range from USD 7,800 to USD 51,000, with 12-36-month repayment periods. Miners have received generators, compressors, water pumps, ball mills, and winches (mine hoists) with one outlier, a mining operator in whom TIF financed the construction of a VAT leaching plant, a mercury-free chemical processing facility that uses sodium cyanide for gold processing.

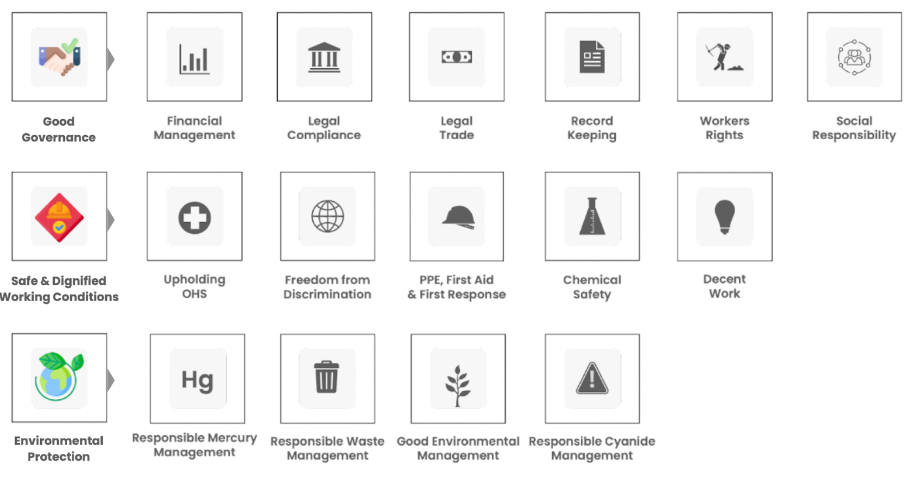

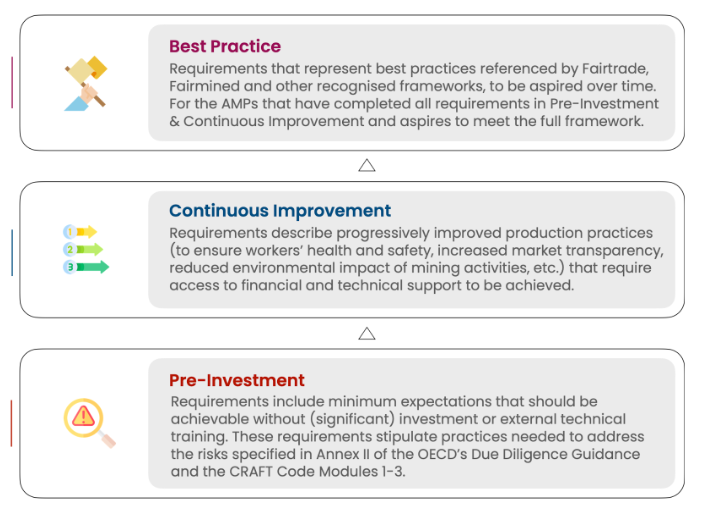

Once onboarded, miners receive continuous support based on Investment Partnership Plans (IPPs) created against their baseline ESG performance to enable and incentivize continuous mine site improvements, where mercury reduction is emphasized as a priority, encouraging the long-term adoption of gravity-based systems or direct leaching or as medium to long-term substitutes. Miners are incentivized to make improvements against the Impact Escalator to unlock larger financing amounts and better contract terms in subsequent investments.