The Impact Facility was set up to provide artisanal and small-scale mineral producers with access to equipment and capital financing to enable the professionalisation of mining enterprises and subsequently, the sustainability of mining communities. As of 2021, we have the backing of impact investors that firmly believe in the viability of the sector and on the services being rolled out currently being rolled out.

Leveraging the investor capital to avail our lease-to-purchase solution, it is important that the investees – the miners we onboard – demonstrate a commitment to make the necessary repayments as part of the effort to showcase to formal finance institutions the investability of the sector. For this, we are implementing a rigorous process in the identification of the right recipients, and in the promotion of our investments – tailored to the complexities of the artisanal mining sector.

Miners Business Roundtable Meetings

The lease-to-purchase service, developed and launched by our team, avails capital and relevant equipment to miners and we are actively on the lookout for miners that may benefit from this investment opportunity. The Miners Business Roundtable Meetings – periodic events facilitated and hosted by our team – are a part of the effort to raise awareness of our service offering.

These meetings are organized in regions with intensive mining activities and attendance is by invitation. The participants invited are miners who have been referred by their mining groups or associations, regional government representatives, other partner NGOs or existing miners working with TIF.

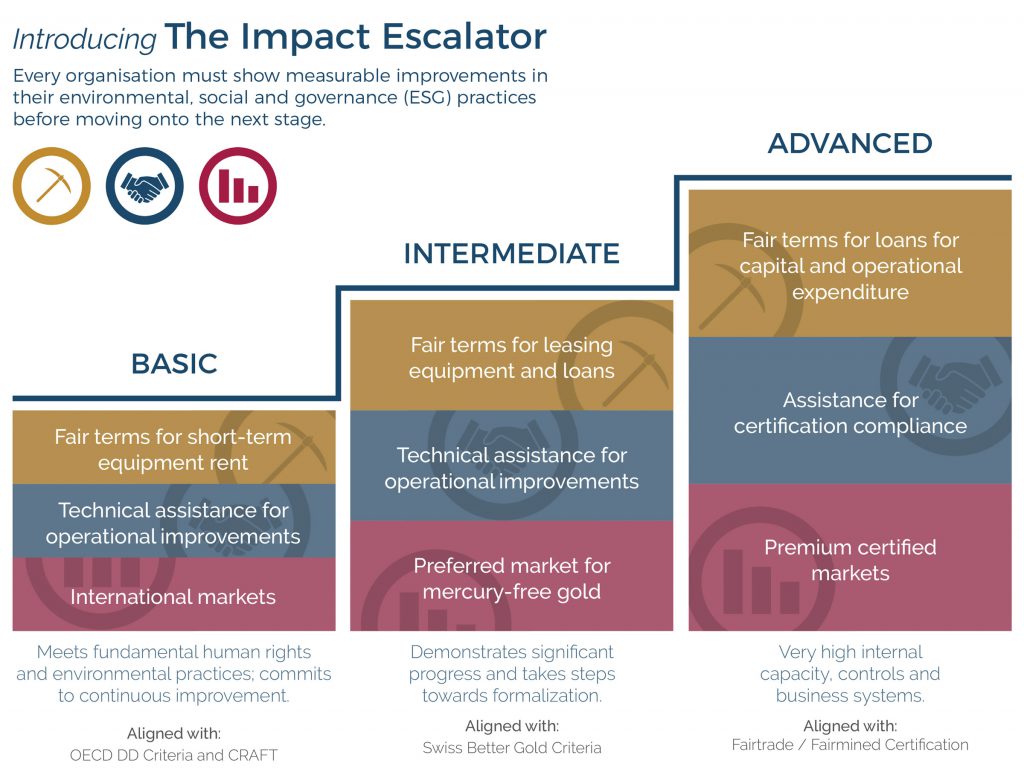

The objective of these meetings is to introduce the leasing concept to miners and elaborate on the terms of engagement and enrollment into the programme. In collaboration with our partner Solidaridad, The Impact Facility has created an assessment method known as ‘The Impact Escalator’ to assist in assessing miners at their current level of operations while identifying areas of support and continuous improvement of their operations as we seek to onboard them onto the equipment leasing service.

Through this recruitment exercise, our objective is to create awareness among miners on how to increase productivity of their mines, the benefits of record keeping and the importance of basic ESG safeguards in their mines. Whether a miner gets to qualify for the leasing service or not, we aim to impact and enrich all miners that we engage with along the way.

‘Mine your own Business’

Our leasing approach entails changing the mindsets of miners to view their mining operations as entrepreneurship ventures – businesses geared towards sustainable profitability rather than the current luck-based engagement approach practiced in the sector.

To start the process, miners are issued with client onboarding forms to profile their mine operations and resubmit back to our team for review. Our team later schedules mine visits to the applicants’ mine operations, conducting Environmental Social and Governance (ESG) assessment based on The Impact Escalator.

The Impact Escalator: Developed in collaboration with Solidaridad

The Impact Escalator enables our team to ascertain the level at which each mine is operating, categorizing the mine into one of these four levels of operation; Know your customer (KYC), Basic, Intermediate and Advanced levels. The report from the assessment determines the level of investment and support the mine is eligible for.

Concurrently, the ESG assessments highlight areas in need of continuous improvement for each mine engaged. The areas of improvement for each mine are mutually agreed upon and prioritised with the artisanal mineral producer, and the progress against these criteria, upon verification, unlocks subsequent investment into the mine site. This provides an incentive to the miners to not only improve mine operations but also meet downstream expectations of responsibly mined gold.

Minimum criteria for mine onboarding

Legal Registration documents

A non-negotiable for mine onboarding – to protect our assets – the legal registration of the artisanal mineral producer (AMP) should be valid and verifiable by local authorities. The registration status for the mine can either be in the form of a limited company, a sole proprietorship, a Sacco, a cooperative or a registered self-help group. For investment eligibility, we prioritize mines that are compliant with the legal registrations as per their country of operation.

Active mine operations and consistent mine records

Miners seeking investment must be in active gold production for a period of not less than six months prior to application. We use 2-3 months production records of the mine to evaluate the feasibility of the mine. A dormant or start-up mine is not considered for financing or investment.

The Impact Facility verifies and ensures that each mine has a mechanism for record-keeping. These records include ore production, gold sales, expenditure and an updated workers registry. We undertake capacity building to raise the financial literacy of the mines that need our support in documenting and aggregating this data , providing templates for record keeping as a starting point where our support is necessary.

Land ownership

All mining happens on land and in the cases of alluvial gold, on the shores of rivers or water bodies. A majority of the mines we engage with undertake their mining operations underground, hence clarity of the land ownership arrangements is a key priority for our leasing facility. Where the miner owns the land, a land title deed or its equivalent is provided as proof and in the case that mine operations occur on rented or leased land, we require a written land lease agreement with the landowner. On the chance that mining occurs on public land, we request the mine to have in its possession a written land consent from the respective county governments or local authorities.

Documented financial transactions

Key to professionalising mining operations is the existence of active and dedicated bank accounts or mobile money accounts that capture the AMPs financial operations. As part of our due diligence, some copies of bank statements and/or mobile money statements are shared with us by each mine for our internal review, treated as confidential information for internal evaluation only.

Mine recruitment journey – the experience, lessons and challenges

On 16th December 2021, we held our inaugural mining business forum in Kakamega and 21 gold miners were in attendance. This forum had a substantive representation of six women, representing 29% of the attendees. We since held meetings in the counties of Migori and Lolgorien in Western Kenya and in the district of Mubende, in Eastern Uganda – with a total attendance of over 50 miners.

The journey to recruit and onboard miners has been characterized by its share of intrigues and challenges along the way. One of the main challenges we faced was in the process of vetting to identify potential participants for the business forums. Most of the miners claimed to be in active production, however, on further inquiry and upon requesting them to share their production records, they could not or did not have them.

Another challenge experienced as we reach out to miners is the misconception of how The Impact Facility operates. Some of the miners have a preconceived notion that TIF’s engagement is similar to that of other NGOs that offer grants or free equipment, a challenge that has persisted since TIF’s first engagement into East Africa. Our team is endeavouring to create awareness among miners around the leasing model and the contractual obligations towards making repayments – endeavouring to assist in educating miners on the professionalisation of their businesses through the development of the community’s entrepreneurial skills.

Upcoming events

TIF has received numerous inquiries and applications for the equipment leasing service from miners who have attended the recruitment events. This attests to the success of the recruitment events organized so far and the interest of miners to benefit from this opportunity towards increasing their mines’ productivity and profitability. A total of 13 mines assessments in Migori and Narok Counties in Kenya have been conducted since the inception of these events, and while we still have some of these mines under assessment, a few of the mines have been approved for investment and as of March 16th, 2022 the first contract has officially been signed.

We look forward to hosting several outreach events in the coming months. If you are interested in receiving investment and would like to know more about our equipment leasing service, please note that we plan to have an outreach event on the 29th of March 2022 in Vihiga County. The target will be miners in Vihiga, Kakamega, Bondo and Kisumu. We are also scheduled to start onboarding miners in Uganda and shall host a recruitment event in Mubende, Uganda in the month of April. Following requests from miners who missed the first event in Migori, we have organized for a second event in Migori in April as well.

For further information on how to participate in the recruitment events or how to apply for the TIF equipment lease service, contact us at [email protected].